Some Of Personal Loans copyright

Wiki Article

The Main Principles Of Personal Loans copyright

Table of ContentsPersonal Loans copyright Fundamentals ExplainedOur Personal Loans copyright Ideas3 Easy Facts About Personal Loans copyright ShownThe Best Strategy To Use For Personal Loans copyrightThe Best Strategy To Use For Personal Loans copyright

For some lending institutions, you can inspect your eligibility for an individual loan using a pre-qualification process, which will certainly show you what you could get approved for without denting your credit report. To ensure you never miss a finance settlement, think about establishing up autopay if your lending institution provides it. In many cases, you may also obtain a rate of interest price cut for doing so.This includes:: You'll require to show you have a job with a steady income so that you can pay back a lending., and other information.

The Facts About Personal Loans copyright Uncovered

A reasonable or bad credit report might restrict your alternatives. Individual lendings also have a few costs that you require to be prepared to pay, consisting of an origination fee, which is used to cover the price of refining your finance. Some loan providers will let you pre-qualify for a financing prior to sending an actual application.This is not a difficult credit report pull, and your credit report score and background aren't affected. A pre-qualification can help you weed out lending institutions that will not give you a funding, but not all lenders offer this choice. You can compare as many lenders as you would certainly like with pre-qualification, that method you just have to complete an actual application with the loan provider that's most likely mosting likely to authorize you for a personal funding.

The greater your credit report, the most likely you are to get the most affordable rate of interest used. The reduced your score, the harder it'll be for you to qualify for a car loan, and also if you do, you can wind up with a passion rate on the higher end of what's supplied.

The Facts About Personal Loans copyright Revealed

Numerous lending institutions provide you the option to establish autopay and, in some cases, offer a rate of interest discount for doing so - Personal Loans copyright. Autopay lets you establish it and neglect it so you never ever need to fret about missing out on a lending settlement. Payment history is the largest element when determining your credit report, and falling back on funding settlements can negatively impact your score.The borrower does not have to report the amount obtained on the financing when declaring taxes. If the funding is forgiven, it is considered a terminated financial debt and can be tired.

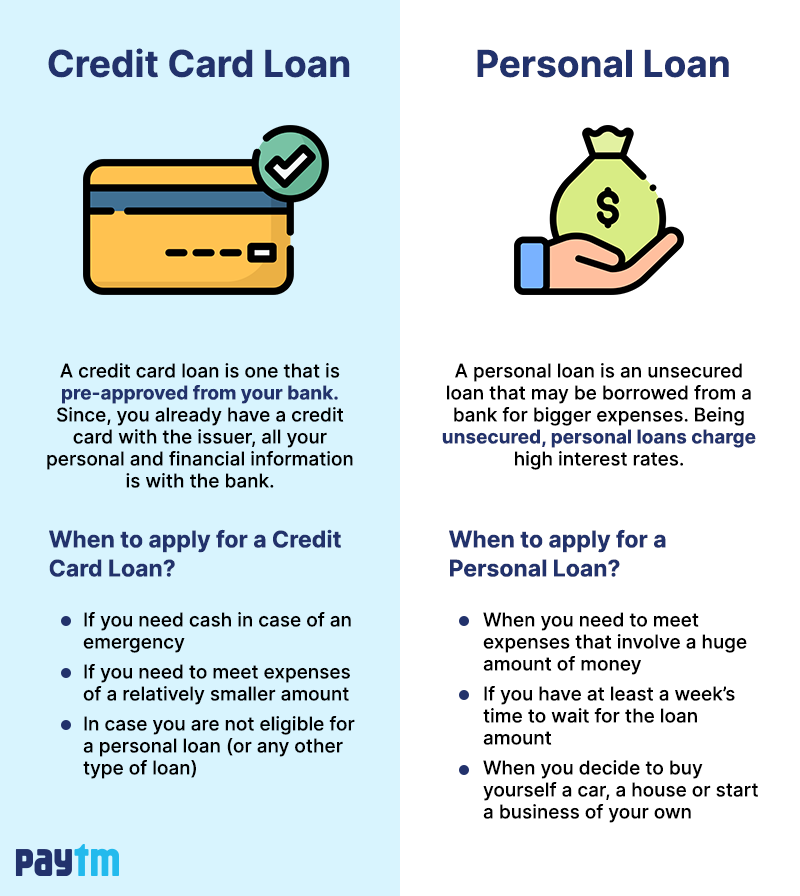

Both personal lendings and bank card are 2 choices to borrow cash up front, but they have different functions. Consider what you need the money for prior to you choose your settlement choice. There's no wrong selection, however one could be a lot a lot more pricey than the various other, relying on your requirements.

They aren't for everybody (Personal Loans copyright). If you do not have a co-signer, you might certify for an individual car loan with bad or fair credit, however you might not have as many choices contrasted to someone with good or superb credit history.

An Unbiased View of Personal Loans copyright

A credit history of 760 and up (excellent) is a lot more likely to get you the most affordable rate of interest rate readily available for your lending. Customers with credit report of 560 or below are extra most likely to have problem getting better car loan terms. That's this article because with a reduced credit rating, the interest price has a tendency to be expensive to make a personal lending a practical borrowing alternative.Some aspects carry even more weight than others. 35% of a FICO click here to find out more score (the kind made use of by 90% of the lending institutions in the country) is based on your payment background. Lenders intend to be sure you can deal with financings responsibly and will certainly consider your past practices to obtain an idea of exactly how responsible you'll remain in the future.

In order to maintain that section of your rating high, make all your payments in a timely manner. Can be found in 2nd is the amount of charge card financial debt impressive, about your credit line. That represents 30% of your credit report and is understood in the sector as the credit history utilization ratio.

The lower that ratio the much better. The size of your debt history, the kind of credit history you have and the variety of new credit applications you have just recently loaded out are the other aspects that establish your credit rating. Beyond your credit history, loan providers consider your income, work history, fluid assets and the quantity of total financial obligation you have.

Personal Loans copyright for Dummies

The greater your income and properties and the reduced your other financial debt, the much better you look in their eyes. Having a good credit rating when looking for an individual financing is necessary. It not just establishes if you'll obtain authorized yet just how much rate Our site of interest you'll pay over the life of the lending.

Report this wiki page